Adam Tooze | December 6, 2020 | THE GUARDIAN

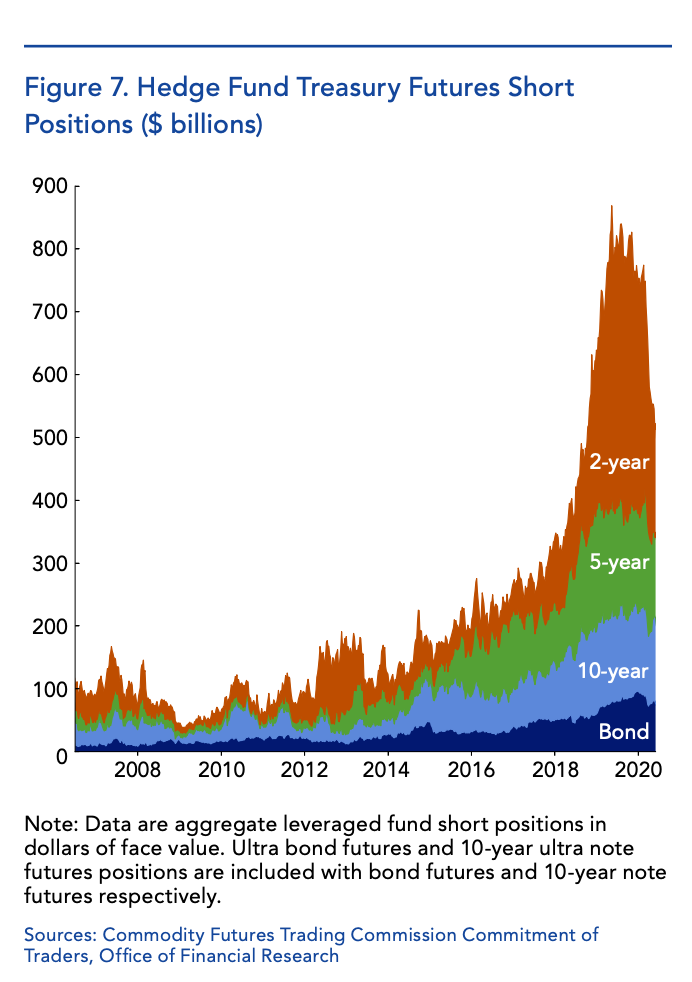

Last week’s newsletter #5 on the turmoil in the all-important US Treasury market in March 2020 generated some interesting reactions, specifically with regard to the role of hedge funds. Was selling by hedge funds more important than I had suggested?

I based newsletter #5 on two sources from the Fed: a speech by Lorie Logan of the New York Fed and the Financial Stability Report. They have in common that they deemphasized selling pressure coming from hedge funds, emphasizing, instead, the role of foreign reserve managers and mutual funds.

As the Fed remarked:

“In sum, the reduction in hedge fund Treasury positions may have contributed notably to Treasury market volatility in mid-March amid a massive repositioning by a wide range of investors. However, so far, the evidence that large-scale deleveraging of hedge fund Treasury positions was the primary driver of the turmoil remains weak.”

Empirically, this assessment is heavily shaped by a paper by Vissing-Jorgensen. This suggested that selling by hedge funds was the smallest of the three groups of sellers.

Originally published by Adam Tooze on Substack. CONTINUE READING HERE.